Have you considered preparing taxes for your Schedule C self-employed clients, but were told it is too scary? Are you interested in increasing your profitability by extending your service offerings to Simple Schedule C […]

From the self-employed Tag

With the tremendous growth of the “gig economy”, “temp on demand work” and/or “contingent work” (all the same thing but using very confusing words), we should ALL be asking ourselves this same question: Am […]

As a Small Business Consultant and Tax Professional who specializes on the recently self-employed/ sole proprietorship, I get asked very often “what is the BEST accounting solution for my NEW business”? I am sure […]

So last year you started working “on your own” which means you NO LONGER get paid a payroll paycheck through an employer and instead you get paid as a 1099 Subcontractor AND you may […]

What You Need To Know About Intuit Quickbooks Self-Employed Download transactions from your bank & credit card accounts, then separate business from personal activity for Schedule C purposes Set rules to auto-categorize from […]

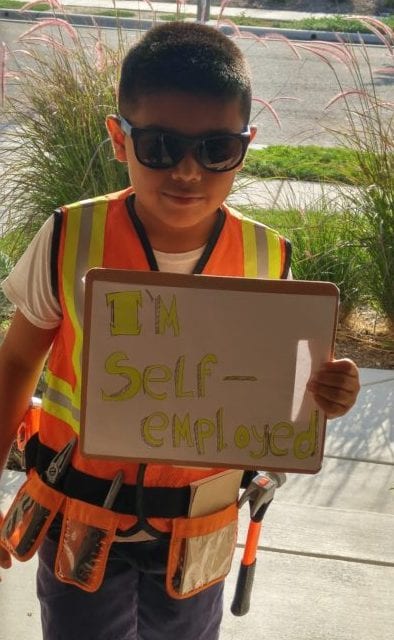

YOU ARE SELF-EMPLOYED! Now what? SELF-EMPLOYED PAY SELF-EMPLOYMENT TAX If YOU ARE self employed, you must pay Self-Employment Tax aka SE tax. SE tax is Social Security and Medicare tax. You may have heard […]

ARE YOU SELF-EMPLOYED? If you answer YES to any of the below items, then, YOU ARE SELF-EMPLOYED! Are you in business for yourself- YOUR THE BOSS Do you carry on a business as a […]