Affordable Care Act “ACA” is a new addition to this year’s tax preparation Knowing Where To Start Key provisions of the Affordable Care Act (ACA or Obamacare) were implemented in January 2014, […]

From the 'Managing Personal Finances & Tax Planning' Category:

Tis the Season To Be Charitable…The CA College Access Tax Credit Fund Provides HUGE TAX BENEFIT on BOTH Federal and California tax returns The College Access Tax Credit Fund is a program that helps […]

Gross Pay Versus Net Pay – A Great Conversation to have when you receive your 1st Paycheck GROSS PAY is the amount an employee earns on a each paycheck BEFORE TAXES. NET PAY, also […]

Free Resource to Learn & Understand Your Taxes The program is a free online tool designed by the IRS as a quick and simple way to learn about your taxes. It’s called: UNDERSTANDING TAXES […]

Paying your taxes on IRS.gov for free A secure service to pay your tax bill or make an estimated tax payment directly from your bank account at no cost to you. You’ll receive instant […]

As a result of the Hundreds of Thousands attempting to purchase health care this Monday, Covered California’s Executive Director Peter Lee has advised that the exchange would “adjust our policy” and allow anyone who […]

If the IRS Calls, Hang Up One of the LARGEST phone fraud scams of IRS impersonators is underway this tax season and thousands of victims have lost more than $1 million as a result […]

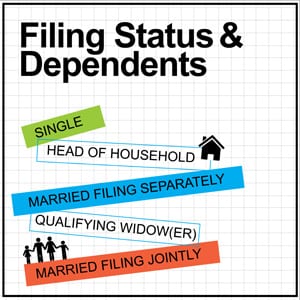

Your FILING STATUS is used to determine filing requirements, standard deduction, eligibility for certain credits/deductions, and most importantly your correct tax liability for the end of the tax year. It is also an area […]

If you have already filed your Federal and State tax returns but have not received you tax refunds, here’s a great tip on how to quickly locate your IRS & California money! Both websites […]

Keep this list handy for the next few weeks to make certain you have collected all the tax documents you need to prepare your taxes. Click on the links to see what each […]