How to Choose an Online Accounting Solution for a Service-Based Self-Employed Business

As a Small Business Consultant and Tax Professional who specializes on the recently self-employed/ sole proprietorship, I get asked very often “what is the BEST accounting solution for my NEW business”? I am sure you can assume what my response is… “It depends”. The reason I provide that response is because it is critical that I get a better idea on what factors are important to my client before I can recommend an accounting solution that will best fit their needs. Today, the accounting professional is focusing on a more trusted advisory role and for this reason, it’s important we LISTEN to our client’s pain points and unique needs before advising them on yet another solution to use for their business.

As a Small Business Consultant and Tax Professional who specializes on the recently self-employed/ sole proprietorship, I get asked very often “what is the BEST accounting solution for my NEW business”? I am sure you can assume what my response is… “It depends”. The reason I provide that response is because it is critical that I get a better idea on what factors are important to my client before I can recommend an accounting solution that will best fit their needs. Today, the accounting professional is focusing on a more trusted advisory role and for this reason, it’s important we LISTEN to our client’s pain points and unique needs before advising them on yet another solution to use for their business.

In this blog, I am going to focus on a newly self-employed individual also referred to as a 1099 Independent Contractor in a Service-Based profession with limited need for invoicing and no product selling. Based on this type of individual, I have learned that there are a 5 Key Elements for an accounting solution to best fit this individual’s need:

- Anytime, Anywhere Access –This type of individual is usually on the go

- Pricing – As first-time self-employed, low-cost solutions are best; Free Trial is a PLUS

- Bank & Credit Card transactions import capabilities – Bank feeds (i.e. automated bank transaction import) are the future of efficient bookkeeping; No More manual entry

- Reporting – Basic financial reports are essential for year-round profitability analysis & preparation for year-end taxes

- Mobile App Capabilities such as Receipt Capture & Auto Mileage – If the accounting solution can provide additional features that can eliminate the need for MORE APPs, that’s a PLUS

- Your Accountant’s BIGGEST Request – Shared Access to Your Books

After researching several online accounting solutions that met all of these qualifications including QuickBooks Online (Simple, Essentials, Plus), QuickBooks Self-Employed, Wave, Xero, Zoho Books, FreshBooks, Kashoo & Sage One, I have narrowed my TOP 3 Choices to QuickBooks Self-Employed, QuickBooks Online Simple Start, Wave (in no particular order).

I will list the advantages & limitations for each Top 3 solution below, however, before you read ahead, please use the above list of programs as a good reference for other great accounting solutions that may better fit your business’s unique accounting needs.

Advantages for ALL Top 3 Apps:

- 100% Cloud Based Accounting Solution – all solutions are web-based with mobile app capabilities (mobile features vary per app)

- Very Simple to Use – all solutions have dashboards and easy to navigate tool bars that are simple to learn and intuitive to use

- Ability to Separate Business vs Personal transactions – newly self-employed individuals may not have opened a separate business account yet or he/she is still getting used to using the business account for only business purposes (i.e. no comingling); the ability to separate business vs personal transactions is a great solution to fix these mistakes

- Ability to import multiple bank & credit card account transactions – adding/importing a new bank/credit card account to the system and assigning the income and/or expense type to the transaction is super simple

- Basic Accounting Reports – throughout the year, it’s important to keep a close eye on your income & expenses so you have an idea on how your business is doing; even more important is the ability to estimate your income for the year since as a Self-Employed individual, you are responsible to PAY self-employment taxes

- Pricing- all apps provide a FREE trial period and are less than $15/month

- Receipt Capture – as a newly self-employed, keeping track of your receipts in one place is more important than ever to take advantage of the tax benefits of business expenses; the mobile app for all solutions has the receipt capture capabilities which will attach a picture to a transaction

What Makes Each Top 3 More Appealing for YOU?

The following additional features may persuade you one way or the other in your decision on which Top 3 accounting solution is a better fit for you.

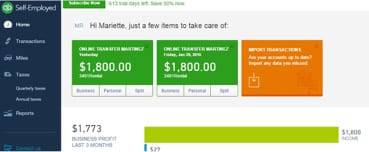

Quickbooks Self-Employed (QBSE) $5/month

- My Favorite Feature in QBSE is the Taxes area – this feature allows for the user to project self-employment income throughout the year and calculates federal quarterly estimated taxes (commonly referred to as SE Tax); since the US is a “pay-as-you-earn” tax system, self-employed individuals should be paying their taxes throughout the year and not all at once at tax time

- Mileage expense integration – this “Miles” feature allows user to keep track of “actual expenses” vs “standard mileage” expense so that you can create your REQUIRED mileage log and keep track of auto expenses right inside the accounting solution; a written mileage log is required by the IRS to take the auto expense as a tax deduction

- Very simple navigation – as you can see, there are only 5 areas to navigate in the entire system so for a user who likes to “keep things simple”, it doesn’t get any simpler than this

Wave $0 = FREE

- It’s REALLY FREE – for the price, this is a great option for a small service-based business; there are additional features like payment processing & payroll you can add on for a fee, but without these features, you pay $0/month

- Invoice customers – if you have a need to invoice customers, this solution allows it

- Access to multiple businesses – in One click, user has access to switch from one business profile to another under the same user login; therefore, you can manage more than 1 business at once

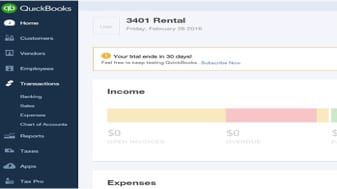

Quickbooks Simple Start $13/mo

- Accounting Solution that allows Growth – this solution is the 1st of 3 fully-functioning accounting solutions built by software giant Intuit that will allow for the user to grow with the product; as your business grows & requires more advanced features such as additional users, accounts payables, company departmentalization, budgeting and many other cool features, the user can seamlessly upgrade to a higher version when ready (at a higher price)

- Customization & Advanced Reporting – this solution allows for the highest scale of customization and advanced reporting since it’s built on the most robust of accounting systems

- Apps Integration Gone Wild – this solution gives user access to hundreds of app integrations which increases your accounting solutions efficiencies Even More

What Makes Your Accountant Happy?

One important feature which is important to bring up AND is the biggest benefit for your accountant is Shared Accountant Access. Both QB Simple Start and Wave allow for the user to create a special accountant login access so that your trusted advisor could have anytime access to your accounting. At this time, QB Self-Employed does not provide a shared access option.

Last but not least, Let’s Talk Limitations (in no particular order)

- QBSE currently allows for no customizations – since this system was built to be very simple and to follow the Schedule C tax filings, the categorization cannot be edited and new accounts cannot be created at this time; in addition, the current available reports are basic and cannot not be edited unless exported to excel

- Customer support is limited – Wave and QBSE provide only email support at the moment However, if you want to upgrade to live chat, Wave allows you to do so for $9.95 per month; customers who would like phone support can upgrade for $19.95/month. For Wave Payroll and Credit Card Processing “paying customers”, they receive an automatic upgrade to the Premium phone support service, at no additional charge.

- Advertising is the trade off – since Wave is free, you have to deal with the constant advertisements throughout the system

- QBSE does not provide bank reconciliation and invoicing – these 2 features are very commonly part of a self-employed monthly bookkeeping process; QBSE does not provide users with these options however, QB Simple Start & Wave do provide these features

- You pay more for QB Simple Start – this is a perfect example of “you get, what your pay for” – even though this solution is most costly of the 3 solutions (by only a few dollars more), this choice definitely allows a scalable platform for the user; in addition, since this is the only “fully functioning, generally acceptable accounting system” out of the 3 choices, you will have access to thousands of professional accountants and bookkeepers that can assist you with the administration and financial growth of your business

My Final Thoughts

At the end of the day, Your Accounting Solution needs to be the best fit for you!

If you are focusing on an accounting solution that will allow for you to project your income and calculate your quarterly estimated taxes, then QBSE might be your choice. However, if your startup business costs are of concern to you, then FREE Wave might be the way to go. And if you are just starting out but foresee your company growing quickly and in need of a more scalable accounting solution, then QB Simple Start will definitely be your first choice.

Regardless of what you decide, ALL of the TOP 3 online accounting solutions will allow for income/expense tracking, bank/credit card feeds, year-round profit analysis, and preparation for year-end taxes. So whichever you choose, you will be better off then where you were yesterday!

- Ready to purchase QuickBooks Online at a GREAT discount? Click the following link to and receive your 50% off MSRP price for the first year!

- Are you a 1099 Contractor/Schedule C taxpayer & have you confirmed that QuickBooks Self-Employed is the BEST fit for your self-employed business? BUY NOW and SAVE 50% for 12 months.

- Check our QuickBooks Comparison chart.

- Watch this short video on QuickBooks Comparisons