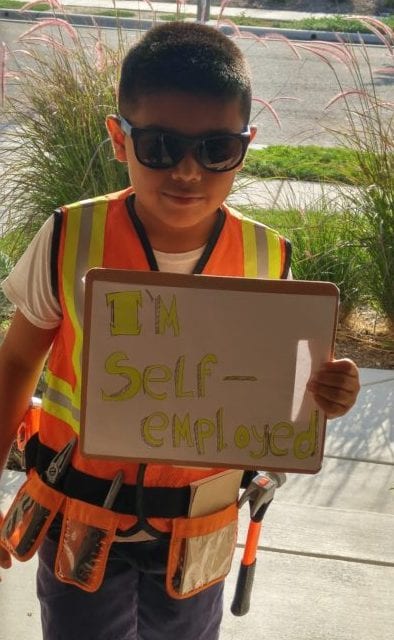

Am I Self-Employed or Small Business Owner? What the Heck Am I?

With the tremendous growth of the “gig economy”, “temp on demand work” and/or “contingent work” (all the same thing but using very confusing words), we should ALL be asking ourselves this same question:

Am I Self-Employed, an Independent Contractor or a Small Business Owner? What the Heck AM I?

I am going to try my best to answer this question in my favorite KISS fashion (last “s” stands for sweetie of course).

Let’s start with some important sincere questions:

- Do you feel like you work 24/7?

- Do you find it difficult to know what your role in the company?

- Do you wear at least 17 hats? (yes, I love 17hats software but I am being literal here)

- Do you find time management to be difficult?

- Did you enter with passion and now you are doing some things you are not passionate about?

- Are you unsure of how you will exit your business?

- Can your business NOT run WITHOUT YOU?

If you answered YES to most if not ALL of these questions, you are definitely Self-Employed.

The biggest difference between Self-Employed and Small Business is that Self-Employed individuals ARE THE BUSINESS and Small Business Owners RUN THEIR BUSINESS. Now this article is not to favor one or the other, it’s mission is to better define what each business actually means.

Here are some additional examples of how to distinguish between Self-Employed vs Small Business Owner ( I will refer to as SBO):

- Self-employed performs all tasks VS SBO hires others to perform task and manages them

- Self-employed usually work alone VS SBO are employers

- Self-employed may be working part-time, have W2 income and/or working after retirement

- SBO is creating a business model that will sustain and provide for future retirement

- Self-employed have minimal overhead and startup costs

- SBO may require capital to sustain, scale & grow their businesses

Now here is where the biggest confusion lies for many:

- Self-employed ARE SMALL BUSINESSES but they are usually “1-person show”

- Self-employed are independent contractors and they can have one OR multiple clients (i.e. Uber driver vs real estate agent vs taskrabbit vs sole tax practitioner)

- Self-employed are Creative Entrepreneurs and usually NOT accountants but they really need one

- Self-employed should ACT like a SBO from the beginning to create good habits and allow for them to transition to this business model seamlessly

Now for the real kicker!!

Why should Accountants/Tax Professionals even care about this tremendous “new economy” multiplying in front of our eyes daily?

Let’s put some numbers to work to answer that!

Based on the Bureau of Labor Statistics in 2005, the combined total of contingent and alternative workers topped 18 million people, or 13.6% of the labor force.

Based on the “Freelancing in America: 2015” study conducted by an independent research firm and commissioned in partnership by Upwork and the Freelancers Union, results showed that approximately 54 million people did freelance work in 2014.

According to April 2015 statistics from the U.S. Government Accountability Office (GAO), more than 40% of all U.S. workers are contingent with the GAO predicting the percentage of self-employed workers to rise to 50% by 2020.

THAT’S OVER 60 MILLION SELF-EMPLOYED INDIVIDUALS!!!

Even more exciting (for nerdy accountants like me) are these 2 BIG Self-Employed Updates:

In May 2017, Bureau of Labor Statistics is working with the Census Bureau to rerun the Contingent Worker Supplement to the Current Population Survey. We will have even more precise stats with the updated study.

Accounting technology giant, Intuit Inc., has invested in creating an affordable online accounting solution for this target market that we can teach & encourage our clients to use and better manage their self-employed finances and tax obligations. Have you heard of it yet…..I sure hope so, if not, here’s some fun reading for you on QuickBooks Self-Employed!

SO I DON’T KNOW ABOUT YOU, BUT I AM BLOWN AWAY BY THESE NUMBERS AND I AM JUMPING ON THIS SELF-EMPLOYED BANDWAGON “YESTERDAY”. ARE YOU?

- Ready to purchase QuickBooks Online at a GREAT discount? Click the following link to and receive your 50% off MSRP price for the first year!

- Are you a 1099 Contractor/Schedule C taxpayer & have you confirmed that QuickBooks Self-Employed is the BEST fit for your self-employed business? BUY NOW and SAVE 50% for 12 months.

- Check our QuickBooks Comparison chart.

- Watch this short video on QuickBooks Comparisons